Loan Servicing so good it will blow your socks off.

What We Do

Our Solutions

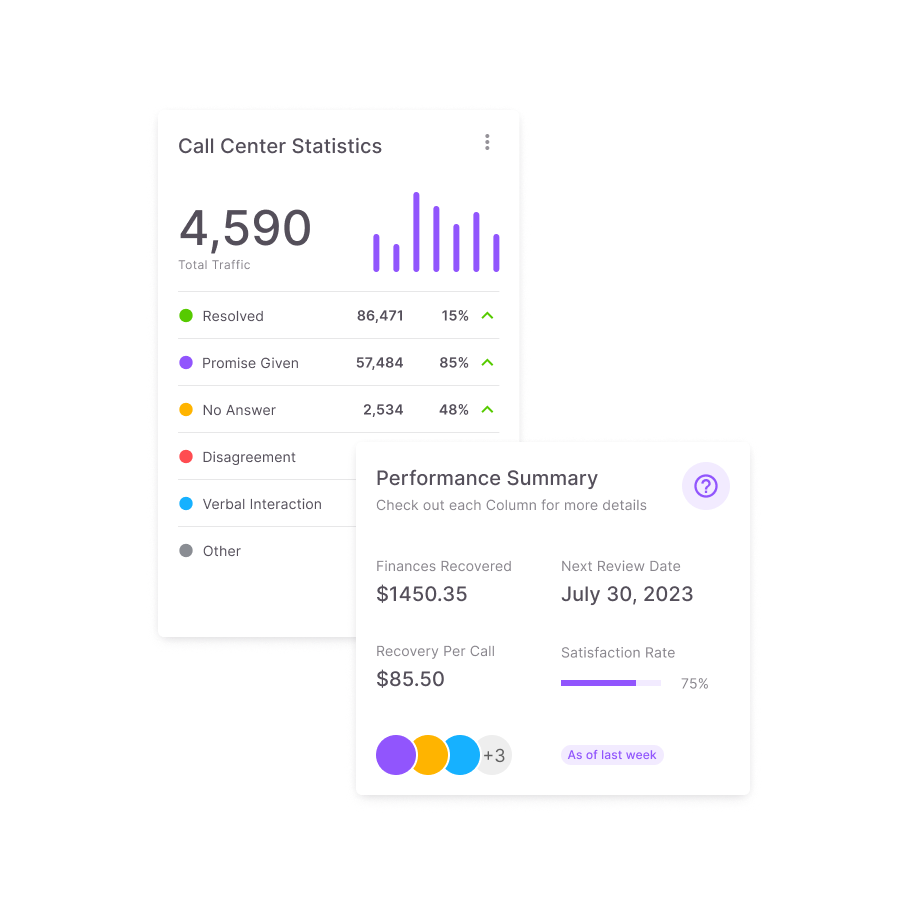

Loan Administration

Payment Processing

Portfolio Analysis & Reporting

Delinquency & Default Management

Technology

Who We Serve

Markets

Affiliations

How to qualify your loan service partner

The Best in Class

Why Concord?

Over 30 Years

Leveraging 30+ years of experience, we deliver unparalleled expertise, fostering long-lasting partnerships and innovative loan servicing solutions.

Award Winning

Experience award-winning excellence in loan servicing, consistently surpassing expectations and fostering successful client relationships.

Omni-Channel Communications

Omni-channel communications for seamless interactions, elevating customer experience, and boosting engagement across platforms.

Read More

Insights

5 Steps to Successfully Outsource Your Loan Servicing

Concord Servicing created this guide to successfully outsourcing your loan servicing so you can gain...

Keep Reading

Driving Efficiencies and Growth with Loan Servicing Automation

Concord helped automate, created the ability to scale tasks, and reduced compliance risks which help...

Keep Reading

How to Develop a Successful Solar UCC Strategy

Concord Servicing developed a guide to help solar lenders use UCC filings to recoup losses in event ...

Keep Reading